As an agency owner, my way to financial freedom has been:

1) Having repeatable sales systems in my agency

2) Reinvest the profits each friday into assets

(1/3 real estate, 1/3 stocks, 1/3 digital assets)

The best investors in the world use a repetable framework to analyze stocks.

In this article, I’ll teach you how to analyze stocks like a professional.

Legendary investor Warren Buffett reads 2-3 hours a day

Read about the company

After you found a company that might be interesting, you should start with reading everything you possible can about the company.

Let’s say that you want to analyze LVMH. You start by looking at their

Annual Report

Investor Day/Capital Markets Day presentations

TradingView (Click: “More Financials”)

source: TradingView

After you’ve read a few hours about the company, you’re already able to form a first impression.

If the stock still looks interesting, you can dive deeper and write a full investment case.

Shameless plug, we also run a book club. It’s every thursday. Cool cats only. Ask for an invite via email: [email protected]

Fundamental Analysis

You can use the same FA (Fundamental Analysis) framework for each case.

This also means that the more often you do FA, the better you’ll get at it. This is why I call it a system.

We’ll show you step by step how you can do this.

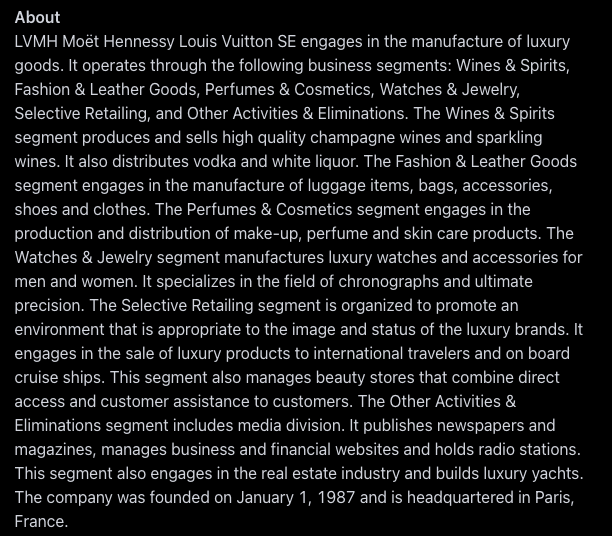

1. Business profile

First things first: it all starts with the business profile.

How does the company make money?

(TradingView, click “More financials”)Do I understand the products/services the company sells?

(TradingView, click “More financials”)

Stay within your circle of competence.

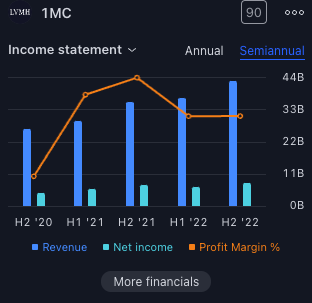

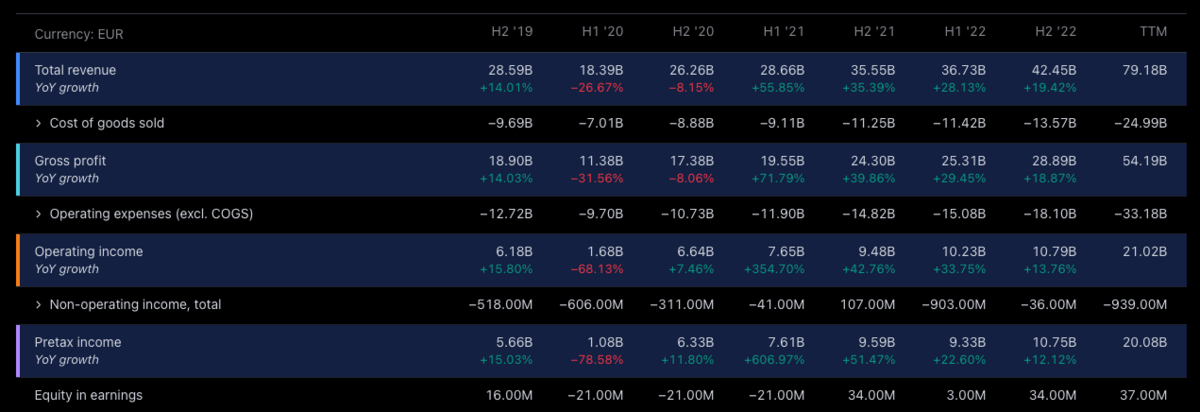

2. Income Statement

After you’ve taken a look at the business profile of the company, you can go on and look at the income statement.

Click “more financials” to go deeper:

I want to see if the single numbers in each line get stronger every quarter, for multiple quarters in a row.

3. Strategic position

How easy is it for competitors to enter their market?

Are they the fastest-growing company in their field?

Can they command prices?

You want to invest in clear market leaders with strong pricing power. Those companies are often characterized by high and stable gross margins as well as high and stable Returns On Invested Capital.

“A good business is like a strong castle with a deep moat around it. I want sharks in the moat. I want it untouchable.“ – Warren Buffett

In today’s markets, moats are rare. The new moats are:

- Network effects

- Growth Rate

- Pricing Power

4. Opportunities and Threats

Identifying the strengths and weaknesses as well as the opportunities and threats of a company is crucial to make good investment decisions.

Invest in companies with a lot of strengths & opportunities but with only limited weaknesses & threats.

Source: Wikipedia

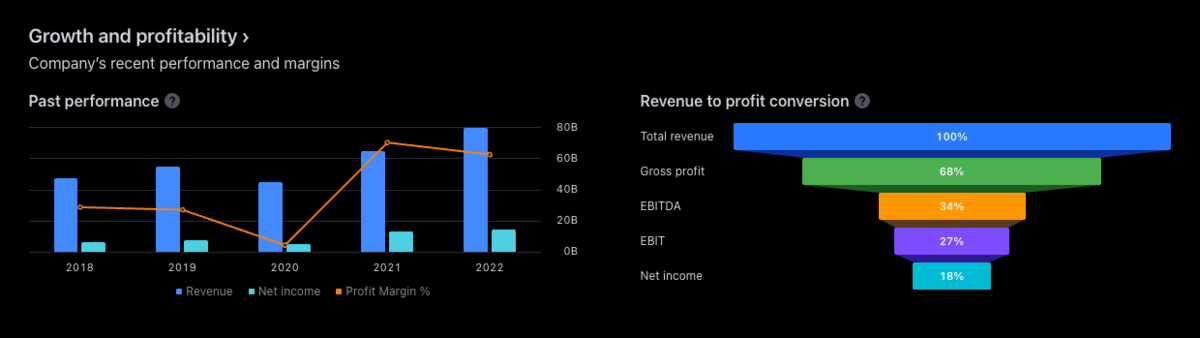

5. Overall growth and profitability

Capital allocation is the most important task of top management.

When a company generates free cash flow, it can allocate this cash as follows:

Reinvest in the business

M&A

Dividends

Share buybacks

In an ideal world, you want to invest in companies which could reinvest their free cash flow in their own business but decide to reinvest in gaining market shares/innovation.

I check overall growth and profitabilty using the free version of TradingView:

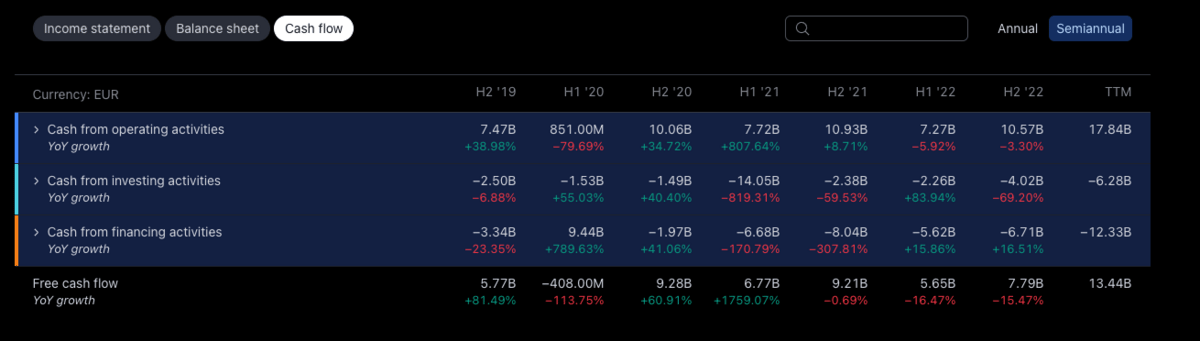

6. Cashflow

Again I want to see if the single numbers in each line get stronger every quarter, for multiple quarters in a row.

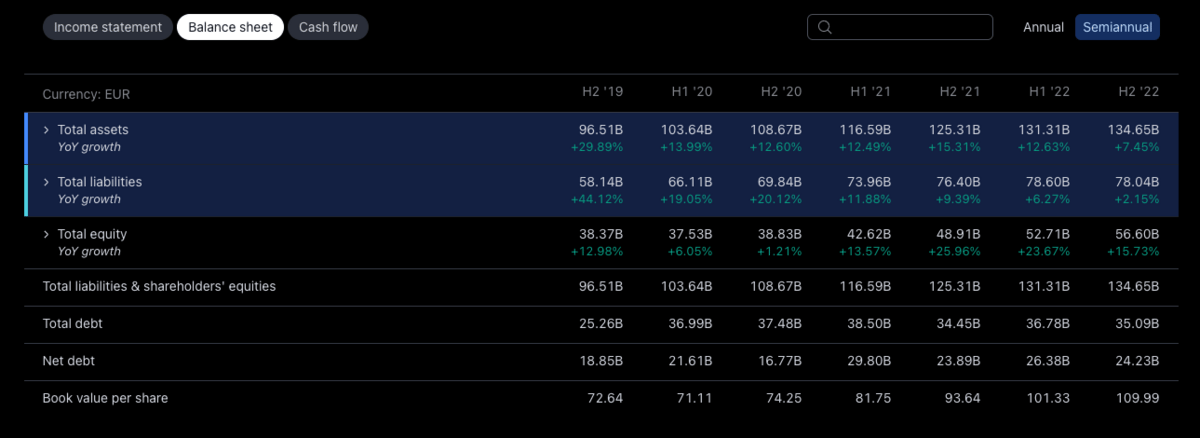

7. Balance Sheet

As a quality investor, you seek for companies which are very profitable.

The gross margin and free cash flow margin are 2 of the best metrics to look at the profitability of a company.

You can calculate the gross margin as follows:

Gross margin = (Revenue - Costs of Goods Sold) / Revenue

The higher the gross margin, the better.

A gross margin of 37.2% means that a company needs $0.628 to produce its products while it can sell them for $1.

The free cash flow margin can be calculated as follows:

Free cash flow margin = free cash flow / revenue

The free cash flow margin shows the percentage of sales which are translated into pure cash for the company. When a company has a FCF margin of 30%, for every $100 the company sells, $30 of cash is generated.

Also here I want to see if the single numbers in each line get stronger every quarter, for multiple quarters in a row.

8. Executive Team

Do you trust their executive team to take the right decisions?

Is the company culture conducive to fast growth?

9. Trend

Now that we have ticked all FA (Fundamental Analysis) boxes, we move to TA (Technical Analysis) to find the right entry point.

You can keep it simple and just using a free version of TradingView, install 3 indicators:

- Lassron Line tells you if trend is up or down:

Bollinger Bands tell you if it currently overvalued (above upper band) or undervalued (below lower band)

RSI Relative Strength Index can be an additional (in)validation that the stock is undervalued (RSI below 20) or overvalued (RSI above 80)

10. Peer comparison

You also want to compare the company you are looking into with its main rivals.

To do this, you can compare all characteristics we’ve already mentioned in this edition of “Agency Life”.

Preferably you want to invest in the best company in that certain field. A market leader with substantially lower capital intensity, higher margins and better capital allocation compared to its peers.

That’s it for today. Repeat this process and you are an agency owner that is on the path to financial freedom.

More from us

Do you want us to scale your agency? Our certified Strategy Sprints coaches do only one thing every day: Help agencies win.

www.strategysprints.com

Simon Severino helps agency owners automate 85% of their B2B sales. He is the CEO of Strategy Sprints and Host of the top 2,5% podcast called "Strategy Sprints". He created the Strategy Sprints™ Method that doubles revenue in 90 days by getting owners out of the weeds. Simon teaches Certified Strategy Sprints™ Coaches to scale agencies via better systems. As a member of SVBS (Silicon Valley Blockchain Society) he enables cross-stage capital flows and helps minimize execution risks in tech scale ups. His team is trusted by Google, Consilience Ventures, BMW, Roche, Amgen, AbbVie and hundreds of frontier teams. He is a TEDx speaker, and has appeared on over 800 podcasts. He writes for Forbes and Entrepreneur Magazine about scaling digital agencies.